Defense giant L3Harris Technologies has announced a significant restructuring of its space portfolio, agreeing to sell a majority stake in its space propulsion business to private equity firm AE Industrial Partners. The deal, valued at $845 million, marks the first major change to the division since L3Harris acquired Aerojet Rocketdyne last year.

Under the terms of the agreement, AE Industrial Partners will acquire a 60% interest in the Space Propulsion and Power Systems business. L3Harris will maintain a 40% ownership stake, continuing its involvement in a sector it has long influenced. The transaction is expected to be finalized in the second half of 2026, pending regulatory approvals.

Key Takeaways

- L3Harris Technologies will sell a 60% stake in its space propulsion business to AE Industrial Partners for $845 million.

- L3Harris will retain a 40% ownership stake in the newly formed joint venture.

- The deal includes the RL-10 engine and in-space thruster programs but excludes the RS-25 engine used for NASA's Artemis missions.

- AE Industrial Partners plans to revive the historic "Rocketdyne" brand for the acquired business.

- The sale aligns with L3Harris's strategy to focus on core national defense priorities like missile production.

Details of the Transaction

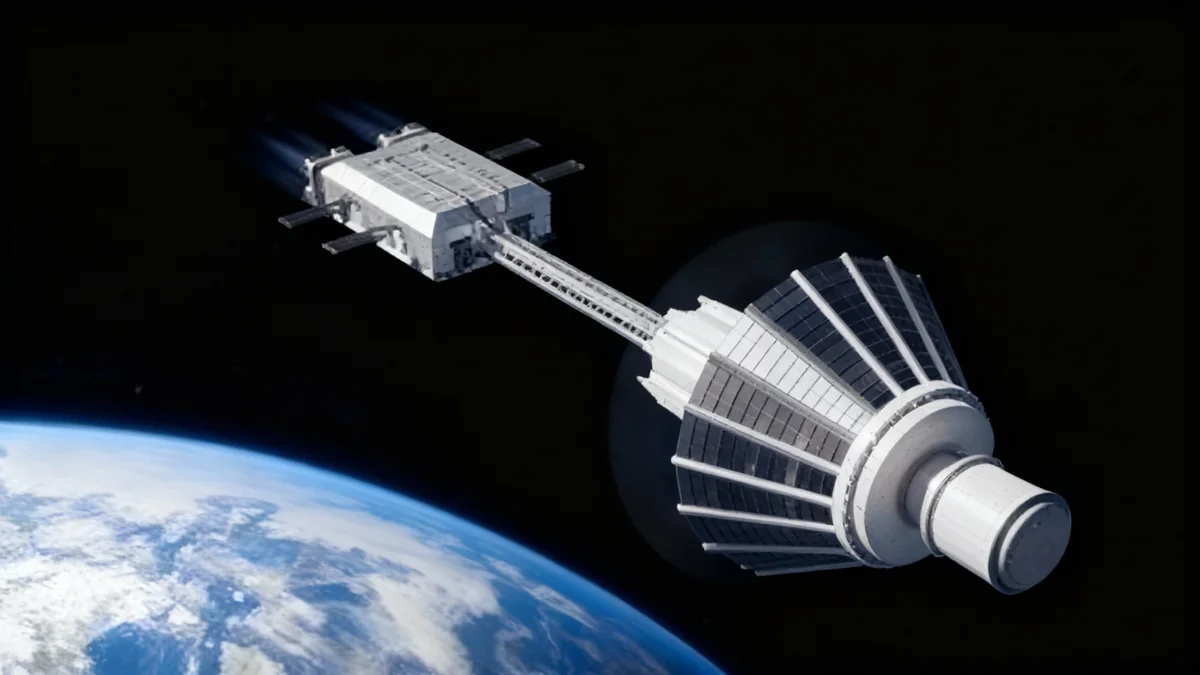

The business unit involved in the sale develops a range of critical space technologies, including advanced rocket engines, in-space propulsion systems, and space power systems. Its portfolio is integral to numerous high-profile missions, providing hardware for everything from Mars rovers to NASA’s lunar Gateway station.

Key assets being transferred include the venerable RL-10 upper-stage engine, which is used on United Launch Alliance's Vulcan rocket. The sale also covers various in-space electric thrusters and advanced power systems crucial for spacecraft longevity and exploration.

However, L3Harris has strategically held back one of its most important assets. The RS-25 rocket engine program, which powers NASA’s Space Launch System (SLS) for the Artemis lunar missions, will remain fully owned and operated by L3Harris. This decision ensures continuity for NASA's flagship exploration program and preserves L3Harris's role as a prime supplier for the agency's long-term deep space ambitions.

A Strategic Shift for L3Harris

This move is part of a broader corporate strategy by L3Harris to sharpen its focus on core national defense priorities. The company has indicated a desire to concentrate resources on missile production and other defense systems that align more directly with the Department of Defense's vision for a more agile industrial base. The divested assets, while critical to the space industry, are seen as a better fit within a portfolio more dedicated to commercial and specialized space ventures.

The Revival of an Iconic Brand

AE Industrial Partners, a firm with a growing portfolio in the space sector, has announced plans to revive one of the most recognizable names in American rocketry. The acquired business will operate under the historic Rocketdyne name, a brand synonymous with the golden age of space exploration.

"Rocketdyne is more than just a company, it is the birthplace of U.S. rocket propulsion," said Kirk Konert, a managing partner at AE Industrial. "This transaction will not only modernize and give new life to a pioneer of space and national defense technology, but it will also create a new hybrid model of agile collaboration."

The firm intends to combine the stability of a defense prime with the innovation of a specialized investor. Konert emphasized a plan to apply modern manufacturing disciplines to the historic RL-10 engine to revolutionize its production line while honoring its legacy design.

AE Industrial's Growing Space Footprint

AE Industrial Partners is not new to the space industry. Its investments include several key players that are shaping the modern space economy:

- Firefly Aerospace: A provider of launch vehicles and in-space services.

- Redwire Space: A company specializing in space infrastructure and on-orbit servicing.

- York Space Systems: A manufacturer of small satellites for government and commercial customers.

Focus on Future Propulsion Technologies

The partnership between L3Harris and AE Industrial is not just about managing existing assets. Both companies have expressed a commitment to accelerating the development of next-generation propulsion technologies. This includes a strong focus on nuclear propulsion, which is widely considered critical for future deep-space exploration and sustained operations in cislunar space—the area between Earth and the Moon.

"We see a unique opportunity to apply our deep experience in scaling space systems to this iconic business," stated Jon Lusczakoski, a principal at AE Industrial. This forward-looking approach suggests the new Rocketdyne will be positioned to compete for contracts related to advanced exploration missions planned by NASA and other international partners.

Implications for the Broader Industry

The restructuring of L3Harris's propulsion business reflects ongoing consolidation and specialization within the aerospace and defense industry. As large defense contractors streamline their operations to focus on government priorities, private equity firms like AE Industrial are stepping in to nurture and grow commercial and specialized space technology assets.

For L3Harris, the deal unlocks significant capital while allowing it to maintain a strategic interest in the propulsion market. For AE Industrial, it represents a landmark acquisition of a business with a storied history and a critical role in the future of spaceflight. The revival of the Rocketdyne name signals a powerful blend of heritage and modern investment strategy, aiming to propel the next generation of space exploration forward.

In a statement, L3Harris Chairman and CEO Christopher Kubasik reinforced the company's direction. "This transaction further aligns the L3Harris portfolio with DoD core mission priorities," he said, emphasizing the company's commitment to shareholder value and national security customers.