The number of active satellites in low Earth orbit has skyrocketed from less than a thousand in 2019 to over 10,000 today, largely driven by megaconstellations like SpaceX's Starlink. This rapid growth is creating an unprecedented traffic management crisis, with forecasts predicting at least 70,000 satellites by 2030.

The surge has spawned a new industry focused on space domain awareness (SDA), but a fragmented market is flooding satellite operators with conflicting data. Now, experts are calling for a unified system, akin to air traffic control for space, to prevent catastrophic collisions and ensure the long-term safety of orbital operations.

Key Takeaways

- The satellite population in low Earth orbit has increased tenfold since 2019, with projections showing a 700% increase by 2030.

- Satellite operators are overwhelmed by inconsistent alerts from a fragmented market of space tracking companies.

- There is a growing consensus that a collaborative, unified system similar to air traffic control is needed for space.

- Artificial intelligence is becoming essential for fusing data from different sensor types and providing actionable insights.

- The future of the industry is expected to involve consolidation and a shift from competing data catalogs to shared, interoperable systems.

The Data Deluge in Orbit

The orbital environment around Earth is fundamentally different than it was just a few years ago. The rapid deployment of thousands of satellites has created a complex and congested highway in the sky, transforming how space is monitored and managed.

Satellite operators now face a new challenge: an overabundance of information. With numerous private companies offering tracking services, operators often receive overlapping and contradictory collision warnings.

"The problem the operators are facing is that now there is almost too much information, and they don’t know what to do with it," said Joe Chan, chairman of the non-profit Space Data Association. "They are getting alerts from many sources, and there is uncertainty of what to do with it."

This "alert fatigue" risks confusing decision-makers at critical moments, potentially leading to incorrect maneuvers or, worse, inaction when a real threat is present. The need for a clearer, more unified picture of space has never been more urgent.

A New Geopolitical Arena

The congestion is not just a logistical problem; it carries significant national security implications. Space is increasingly viewed as a contested domain where strategic competition is intensifying.

According to Tony Frazier, CEO of space-tracking firm LeoLabs, nearly half of the satellites expected to be in orbit by the end of the decade will be operated by U.S. adversaries, with China being a primary player. This adds a layer of complexity to tracking and management.

Orbit by the Numbers

- 2019: Fewer than 1,000 active satellites in LEO.

- Today: More than 10,000 active satellites.

- 2030 Projection: At least 70,000 satellites.

"This rapid growth, coupled with the advancement of counterspace capabilities, means space is a contested domain where strategic competition is intensifying," Frazier noted. Governments, including the U.S. with its TraCSS initiative, are actively working toward systems that can manage space traffic with the efficiency of air traffic control.

A Fragmented Market Seeks a Solution

To fill the current gap, a diverse ecosystem of commercial companies has emerged. These ventures range from those operating their own sensor networks to others that focus on analyzing and fusing data from multiple sources. This has created a complex and sometimes confusing marketplace.

The Sensor Operators

Some companies are investing heavily in proprietary hardware to gather the most precise data possible. This approach provides deep control over the quality and type of information collected.

- LeoLabs operates a global network of ground-based radars that can track objects as small as 10 centimeters in low Earth orbit.

- ExoAnalytic Solutions uses one of the world's largest networks of optical telescopes, focusing on medium Earth orbit and higher altitudes.

- Kratos Space specializes in passive radio frequency (RF) monitoring, using over 190 sensors to detect and characterize signals from satellites during their normal operations.

The Data Fusers

Other companies are taking a "sensor-agnostic" approach. Instead of building their own hardware, they focus on software platforms that can ingest and make sense of data from various partners. Their goal is to turn raw data into actionable intelligence.

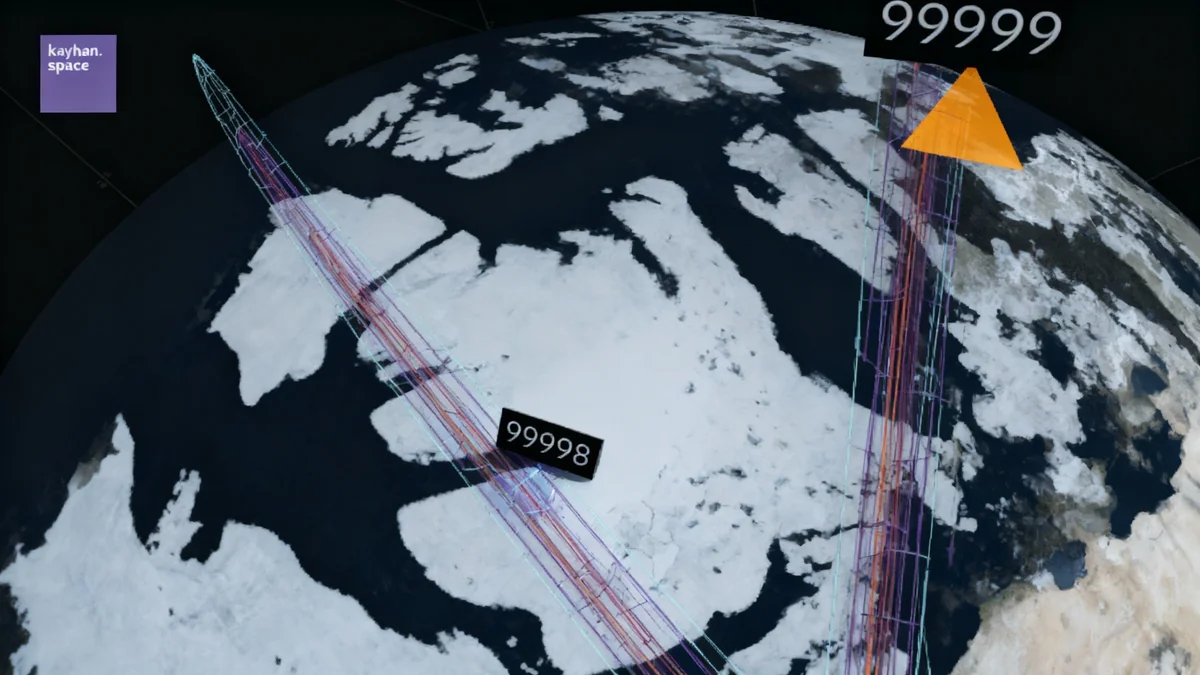

"By remaining sensor-agnostic, we can ingest data from multiple independent sources instead of being limited to a single system’s capabilities," explained Araz Feyzi, co-founder of Kayhan Space.

Companies like Ecosmic and Neuraspace are also building platforms designed to integrate disparate data streams, using AI to automate risk assessment and maneuver planning.

The Call for Collaboration

Industry leaders agree that no single company can solve the space traffic problem alone. The future, they argue, lies not in dominating the market with a proprietary system but in building bridges between different platforms. Chiara Manfletti, CEO of Neuraspace, stated that the "SDA ecosystem is inherently interdependent." The goal is to create federated, interoperable networks that can share data securely while respecting national sovereignty.

The Path to a Unified Sky

As the industry matures, a consensus is forming that the ultimate solution must be collaborative. The focus is shifting from simply creating catalogs of objects in space to developing systems that provide a shared, reliable understanding of the orbital environment.

Technology providers are already working on next-generation platforms. Spanish firm GMV is upgrading the Space Data Association’s system to better integrate multiple data sources and create unified conjunction messages, reducing operator workload and standardizing alerts.

Artificial intelligence and machine learning are central to these efforts. These technologies allow companies to fuse diverse data streams in real time, detect satellite maneuvers in hours instead of days, and provide predictive analytics to proactively identify threats.

"Ultimately, the future of space mapping isn’t about competing catalogs," said Kayhan’s Araz Feyzi. "It’s about collaboration and data fusion to create a better, unified understanding of what’s happening in orbit."

The industry appears to be heading toward a necessary consolidation, where the companies that succeed will be those that can best turn a flood of data into clear, decisive insight. The challenge is no longer just mapping space, but managing it safely for generations to come.