A significant shift is underway in the investment landscape as venture capital and private equity firms turn their attention to the skies. Companies specializing in space defense are attracting substantial funding, driven by the recognition of space as a critical domain for national security and future conflicts.

Mina Faltas, the founder and chief investment officer of Washington Harbour Partners, confirmed this trend, stating that his firm is now actively investing in startups within the space defense sector. This move signals a broader market realization that the next generation of defense technology will be developed and deployed beyond Earth's atmosphere.

Key Takeaways

- Investment firms are increasingly funding startups in the space defense industry.

- Space is now widely considered a critical operational domain for military and national security.

- This trend is fueled by both geopolitical shifts and rapid advancements in private space technology.

- Areas like satellite protection, debris tracking, and secure communications are attracting major capital.

The Final Frontier for Venture Capital

The flow of private capital into the space sector is no longer limited to exploration or tourism. A new, more strategic focus has emerged: defense. Investment leaders are identifying significant opportunities in companies that are building the infrastructure to protect national assets in orbit and provide a strategic advantage from above.

This pivot is a direct response to the evolving nature of global power dynamics. As more nations and private entities gain access to space, the need to secure satellite networks, communication channels, and surveillance capabilities has become paramount.

"We are actively investing in space defense startups because it is a critical war fighting domain," Mina Faltas of Washington Harbour Partners stated in a recent interview.

His comments reflect a growing consensus among investors that the commercialization of space has opened the door for a new wave of defense innovation, moving beyond traditional government contractors to agile and disruptive startups.

From Government Project to Private Enterprise

For decades, space defense was almost exclusively the responsibility of government agencies and their largest contractors. The high cost of entry and the classified nature of the technology kept smaller players out. However, the landscape has changed dramatically over the past decade.

The rise of commercial launch providers has drastically reduced the cost of sending assets into orbit. This has created an ecosystem where smaller, specialized companies can develop and deploy advanced technologies more efficiently than ever before.

Market Projections

Analysts project the global space defense market could exceed $50 billion by 2030, a significant increase driven by private investment and escalating demand for orbital security solutions.

These new companies are focusing on a range of critical areas, including:

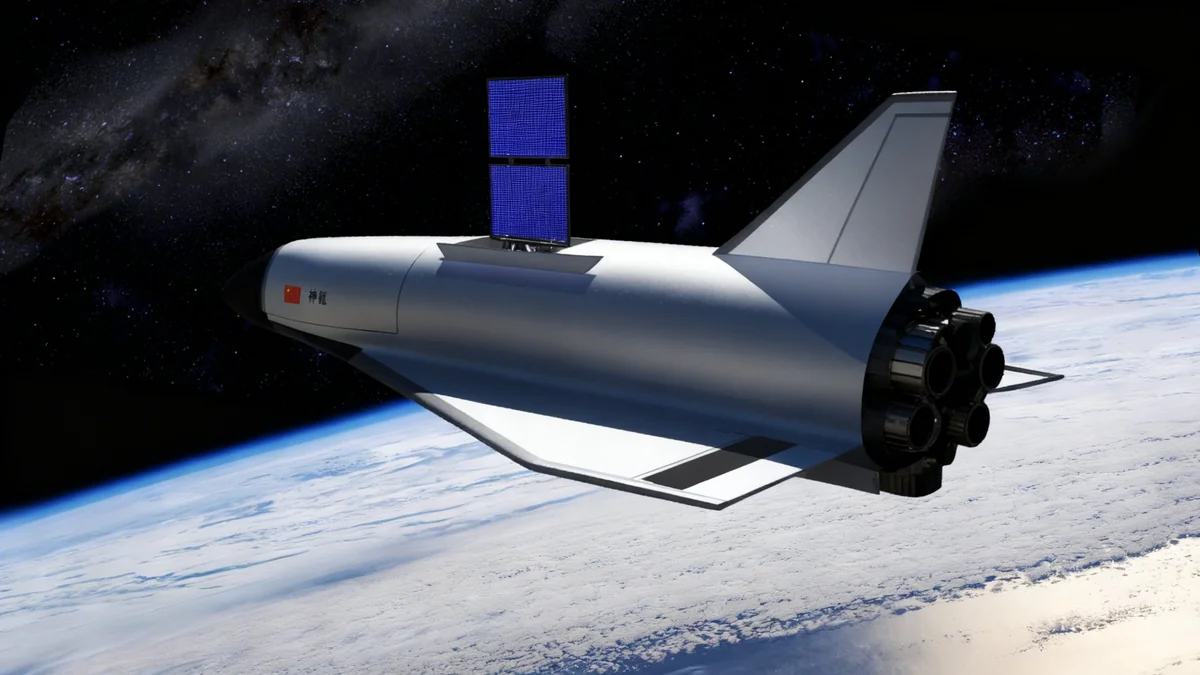

- Satellite Maneuverability and Protection: Developing systems to defend satellites from physical or cyber threats.

- Debris Tracking and Removal: Creating technology to monitor and mitigate the growing problem of space junk, which poses a risk to all orbital assets.

- Secure Communications: Building resilient, next-generation networks that can withstand jamming or interception.

- Earth Observation and Surveillance: Deploying constellations of small satellites for high-resolution monitoring.

The Strategic Importance of Orbital Assets

Modern military operations and civilian infrastructure are deeply dependent on space-based technology. From GPS navigation that guides everything from troops to commercial airliners, to the satellite communications that connect the globe, our reliance on orbital assets is immense.

Why is Space a 'War Fighting Domain'?

The term reflects the strategic reality that controlling or influencing operations in space can determine the outcome of conflicts on Earth. Disrupting an adversary's satellites can disable their navigation, communication, and intelligence-gathering capabilities, providing a decisive advantage without firing a single shot on the ground.

This dependency creates vulnerabilities. An adversary capable of disabling or destroying satellites could cripple a nation's ability to function. Investors recognize that protecting these assets is not just a military priority but an economic necessity, creating a sustainable and profitable market for innovative solutions.

The investment surge is not just about building better hardware. Software, artificial intelligence, and data analytics play a crucial role. Startups that can process vast amounts of data from space to provide actionable intelligence are seen as particularly valuable. This includes tracking potential threats in orbit and monitoring activities on the ground with unprecedented speed and accuracy.

A New Era of Geopolitical Competition

The renewed focus on space defense is also a reflection of the current geopolitical climate. Major world powers are openly developing their own space-based military capabilities, leading to what some call a new space race, this time with a distinct defense and security focus.

Unlike the Cold War-era space race, however, this competition is being heavily influenced by the private sector. The speed and innovation of startups, backed by venture capital, allow for faster development cycles than traditional government programs. This public-private dynamic is accelerating the pace of technological advancement in the space defense arena.

For investors, this environment presents both risks and rewards. The long-term nature of space projects and the regulatory hurdles can be challenging. However, the potential for creating foundational technology in a sector deemed critical for national security offers a compelling opportunity for significant returns. As Washington Harbour Partners and others move into this domain, it is clear that the business of defending the high frontier is just beginning.