Several quantum computing companies experienced a significant stock market rally on Wednesday following a major announcement from the U.S. Department of Energy. The federal agency revealed a new partnership with IonQ, Honeywell, and the Electric Power Board of Chattanooga aimed at developing quantum technology applications for use in space.

The collaboration spurred immediate investor confidence in the sector, leading to notable gains for companies like IonQ, D-Wave Quantum, and Rigetti Computing. The news coincided with major corporate acquisitions by IonQ and the ongoing Quantum World Congress, highlighting a period of intense activity and growth in the industry.

Key Takeaways

- The U.S. Department of Energy is partnering with IonQ and Honeywell to explore quantum technology for space applications.

- IonQ finalized its $1 billion acquisition of Oxford Ionics and also purchased quantum sensor startup Vector Atomic.

- Quantum computing stocks, including IonQ (IONQ), D-Wave (QBTS), and Rigetti (RGTI), saw significant price increases on Wednesday.

- The market activity comes as industry leaders gather for the annual Quantum World Congress in Virginia.

Government Partnership Drives Market Confidence

The Department of Energy's new initiative is designed to accelerate the practical use of quantum systems. By collaborating with commercial leaders like IonQ and Honeywell, the agency aims to transition laboratory-proven technologies into real-world orbital applications.

Anthony Pugliese, the DOE's chief commercialization officer, emphasized the strategic importance of the partnership. He stated that it helps build "the bridge from demonstration to deployment" by involving commercial entities capable of bringing these advanced systems into orbit.

"This (partnership) shows how DOE is building the bridge from demonstration to deployment by adding commercial partners that can bring lab-proven systems into orbit and open pathways to market applications," said Anthony Pugliese in a statement.

This federal backing is a significant validation for the participating companies and the broader quantum industry, signaling growing government interest in leveraging quantum computing for strategic purposes, including those in space.

IonQ Announces Major Acquisitions and Growth

In a busy day for the company, IonQ also announced the completion of two significant acquisitions. The firm officially closed its $1 billion purchase of Oxford Ionics, a move that strengthens its technological base and market position.

Alongside this major deal, IonQ also confirmed its acquisition of Vector Atomic. This startup specializes in advanced quantum sensors for positioning, navigation, and timing (PNT) applications. The U.S. government is Vector Atomic's largest customer, providing IonQ with a crucial link to defense and government contracts.

IonQ's Market Performance in 2025

Following Wednesday's news, IonQ's stock (IONQ) increased by more than 1%, closing at $62.95. This latest rise contributes to an impressive 51% advancement for the stock so far in 2025.

These strategic moves follow IonQ's partnership established in April with Tennessee's Electric Power Board (EPB) to jointly develop a quantum technology center. The company's quantum systems are built using trapped-ion technology, a leading approach in the field.

Widespread Rally Across Quantum Stocks

The positive sentiment was not limited to IonQ. Other publicly traded quantum computing companies also saw their share prices climb on Wednesday, reflecting a sector-wide boost from the DOE announcement and ongoing industry developments.

Key Stock Movements

Several companies recorded substantial gains, indicating strong investor interest in the emerging technology:

- D-Wave Quantum (QBTS): Shares surged 11% to finish the day at $21.10. The stock has seen remarkable growth, advancing over 150% in 2025.

- Rigetti Computing (RGTI): The stock rose 5%, closing near $21. This adds to a yearly gain of 38% for the company.

- Quantum Computing Inc. (QUBT): Shares gained 3% to reach $17.36, bringing its total increase for 2025 to approximately 5%.

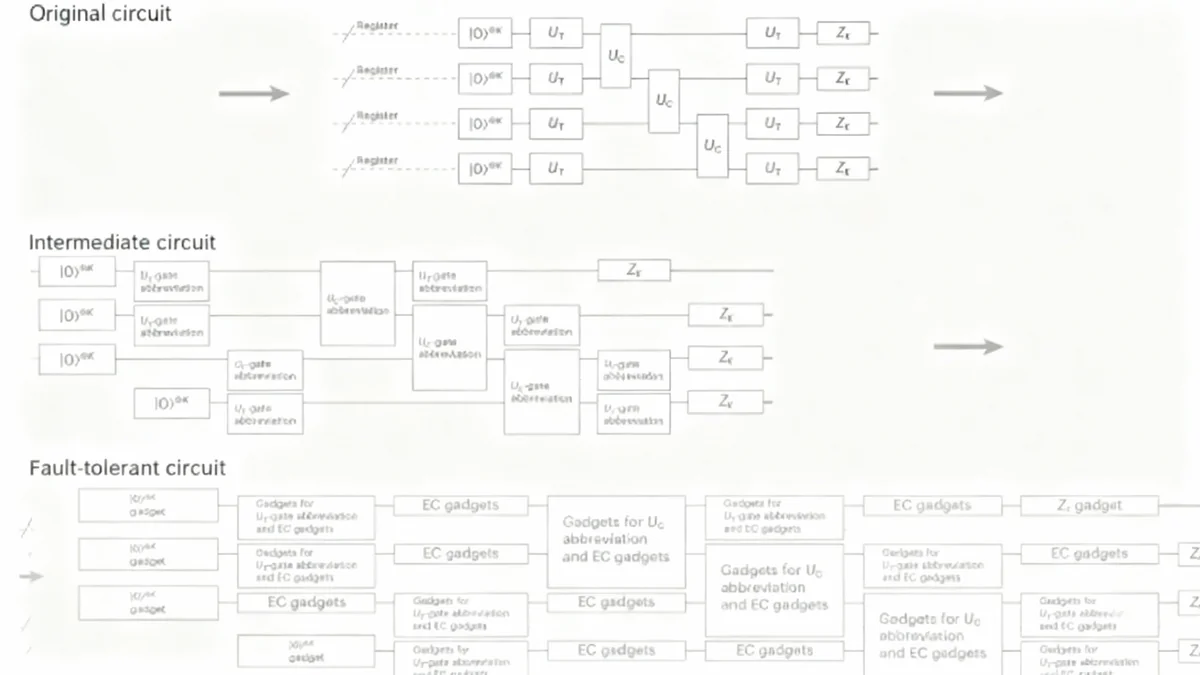

Understanding Quantum Computing

Quantum computing operates on the principles of quantum mechanics, using subatomic phenomena to process information. Unlike classical computers that use bits (0s and 1s), quantum computers use qubits, which can exist in multiple states simultaneously. This capability allows them to solve problems that are too complex for even the most powerful supercomputers, such as simulating complex chemical reactions or breaking advanced encryption.

The industry's stock performance has been volatile throughout 2025. Earlier in the year, comments from Nvidia CEO Jensen Huang raised doubts about the near-term commercial viability of quantum technology. However, Nvidia has since increased its investments in quantum startups, reflecting a broader shift towards embracing the technology's long-term potential.

Industry Gathers at Quantum World Congress

The market rally is taking place as the quantum community convenes for the Quantum World Congress in Tysons, Virginia. This annual conference brings together leading companies, researchers, and policymakers to discuss the latest advancements and future directions of the technology.

The presence of major players and the announcement of significant partnerships and acquisitions during the event underscore the rapid pace of innovation and commercialization within the quantum sector.

Another key player in the industry, Quantinuum, in which Honeywell holds a majority stake, has also been active. The company recently closed a $600 million funding round and, in May, announced a deal with Qatar's Al Rabban Capital. Officials suggested this partnership could evolve into a $1 billion joint venture over the next decade, further highlighting the global investment pouring into quantum technology.