The concept of manufacturing products in space for use on Earth is moving closer to reality, but a commercially viable market does not yet exist. Companies are making significant technological progress, yet the industry remains in a research and development phase, with high costs and logistical challenges preventing widespread production.

Varda Space Industries recently secured an agreement for near-monthly landings of its manufacturing capsules in Australia, signaling growing momentum. However, experts confirm that no products made in orbit are currently available for purchase, highlighting the gap between technological capability and economic profitability.

Key Takeaways

- The space manufacturing sector is currently focused on research and development, not commercial production.

- High costs for launching materials to space and returning finished goods are the primary barrier to profitability.

- Pharmaceuticals and high-value crystals for semiconductors are considered the most promising first markets due to their high value-to-mass ratio.

- Companies like Varda, Redwire, and Astral Materials are developing technologies for in-orbit production and reentry.

- Initial success will likely depend on creating materials that are significantly superior to their Earth-made counterparts.

The Gap Between Potential and Profit

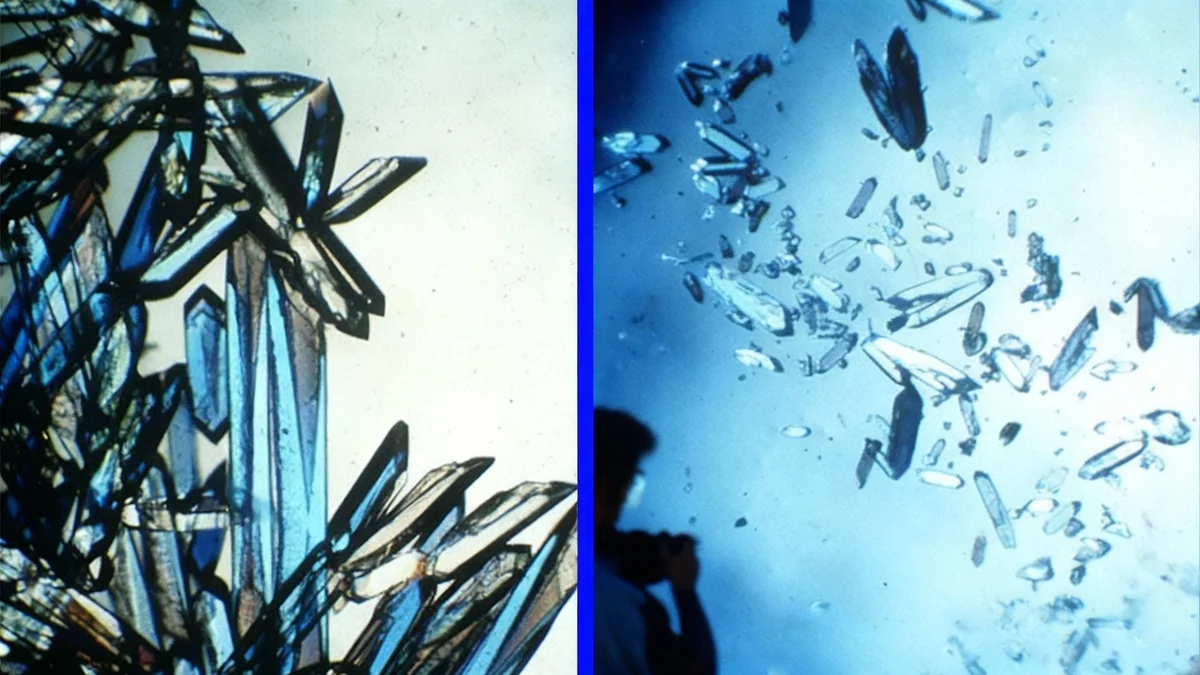

For decades, the promise of manufacturing in low-Earth orbit has captured the imagination of scientists and entrepreneurs. The microgravity environment allows for the creation of materials, such as ultra-pure crystals, that are difficult or impossible to produce on Earth. Despite this potential, the industry has yet to deliver a profitable product.

"I can say very confidently that there are no products that are manufactured in space that are sitting back down on the ground that you or I could go buy," said Eric Lasker, chief revenue officer for Varda Space Industries. He explained that the ecosystem is still in an early stage, focused on collaboration with universities and research institutions.

This reality is a significant departure from the vision NASA held in the 1970s, when the agency anticipated that the space shuttle program would usher in an era of profitable orbital factories. While companies have made progress, turning demonstrations into a consistent revenue stream remains the central challenge.

A Long-Standing Vision

The idea of space manufacturing dates back to the early days of the space age. The absence of gravity and contaminants was seen as ideal for creating superior semiconductors, optical glass, pharmaceuticals, and superalloys. While the science is sound, the economics have proven difficult to solve.

Overcoming Economic Hurdles

The primary obstacle for space manufacturing is cost. Launching materials into orbit and returning them safely is an expensive process. According to Jessica Frick, CEO of startup Astral Materials, companies can charge between $25,000 and $100,000 per kilogram to deliver small experiments to space.

The Pharmaceutical Frontier

Many experts believe pharmaceuticals will be the first economically viable sector for space manufacturing. The high value per gram of certain drugs can help offset the steep costs of spaceflight. Lasker predicts the first profitable product will likely involve biologic medications or monoclonal antibodies.

"IP is where the majority of the economic value in the development chain for pharmaceuticals actually lives," Lasker noted, emphasizing that even late-stage R&D in space could generate immense value.

One promising approach involves growing a perfect "seed crystal" in microgravity. This crystal can then be returned to Earth and used as a template for mass-producing a drug more efficiently. Another possibility is that growing a new crystal structure for an existing drug could allow a pharmaceutical company to extend its patent.

Gold Nanospheres in Microgravity

Redwire, a Florida-based company, is exploring this high-value model by growing gold nanospheres on the International Space Station. In microgravity, these spheres form more uniformly, making them ideal for advanced medical tests for cancer and viruses. According to the company, just one ounce of gold could produce enough spheres for 3,000 tests, making the spaceflight costs a smaller part of the final product's price.

Advanced Materials and the Path to Market

Beyond pharmaceuticals, companies are focused on producing advanced materials for high-tech applications. Astral Materials, a startup founded in 2024, plans to launch orbital furnaces to grow superior silicon crystals for the semiconductor industry.

The Need for a Superior Product

Ioana Cozmuta, founder of G-SPACE, a company that models microgravity manufacturing, explained that commercialization requires more than just a better product. "It’s also, ‘How easy it is to adopt and integrate and upgrade the infrastructure that exists today?’" she said.

For example, space-made fiber-optic glass is of higher quality because it lacks the microcrystal defects common in terrestrial production. However, there is not yet a clear market demand that justifies the higher cost. Similarly, competing with the low price of Earth-made semiconductor crystals is a major challenge.

Jessica Frick of Astral believes the key is to target markets that are desperate for better materials. Her company is focusing on several key areas:

- Quantum computing

- Photonics, optics, and laser systems

- Thermally conductive materials for chip circuit boards

- High-powered silicon carbide devices for electric vehicles

"We have to find something that people already are using and want a higher quality of it," Frick stated. To justify the initial investment, a space-made material must be "orders of magnitude better" than its terrestrial alternative, not just incrementally improved.

The Future of Orbital Production

The consensus in the industry is that the journey to profitability will be gradual. Initial production volumes will be small, likely measured in kilograms per year, before scaling up. The first products will serve niche, high-performance scientific applications before migrating to more common uses.

Redwire's chief scientist, Kenneth Savin, predicts that while seed crystals will likely be the first profitable venture, the long-term potential lies in cellular products. Growing stem cells, organoids, or tissues in microgravity could revolutionize medical research and therapies.

The progress made by companies like Varda, which has successfully launched and landed three capsules, shows that the technical challenges are being solved. The next step is to align these capabilities with a sustainable business model.

"I’m hoping somebody’s going to pull it off," Savin said. "I think it’s going to be us, but somebody will do it and I think it would be good for the rest of the industry when something real starts to happen."